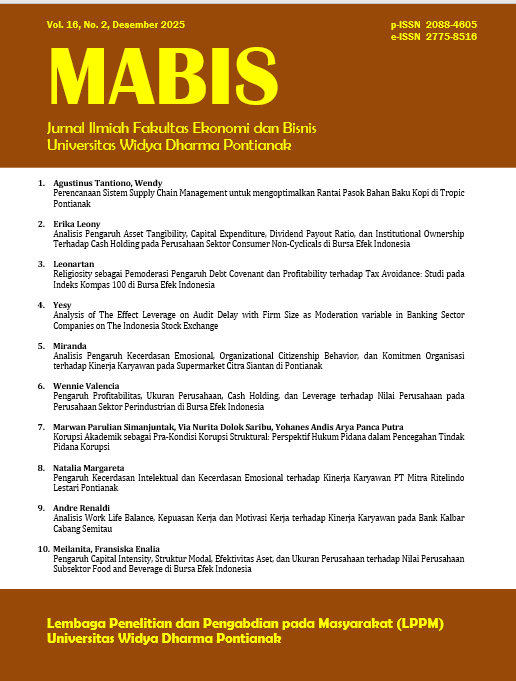

Religiosity sebagai Pemoderasi Pengaruh Debt Covenant dan Profitability terhadap Tax Avoidance: Studi pada Indeks Kompas 100 di Bursa Efek Indonesia

Keywords:

debt covenant, profitability, religiosity, tax avoidanceAbstract

This study aims to analyze the influence of debt covenants and profitability on tax avoidance, using religiosity as a moderating variable. The research employs a causal associative approach. This study focuses on a population of companies included in the Kompas 100 Index and listed on the Indonesia Stock Exchange from 2019 to 2023. A sample of 37 companies was selected using purposive sampling, resulting in 185 observational data sets. The data used are secondary data in the form of company financial reports and information on the list of sharia-compliant securities. Data analysis tools used were IBM SPSS version 26 software. Data analysis techniques included descriptive statistical analysis, classical assumption testing, multiple linear regression analysis, moderated regression analysis (MRA), and hypothesis testing. The results indicate that debt covenants have a negative effect on tax avoidance, while profitability has no effect. The moderation results indicate that religiosity does not moderate the effect of debt covenants and profitability on tax avoidance.

References

Anggraini, P. G., Ayu, P. W. C., Saragih, A. H., & Dharsana, M. T. (2021). Do Sharia and Non-Sharia Listing Securities Investors Respond Differently to Tax avoidance? Jurnal Akuntansi Dan Keuangan Indonesia, 18(1), 3.

Aristiyaningrum, U. L., & Falikhatun, F. (2024). Peran Religiusitas Sebagai Moderasi Determinan Pengindaran Pajak. In Seminar Nasional LPPM UMMAT, 3, 950-963).

Budiman, N. A., & Bandi, B. (2022). Religiusitas dalam Penghindaran Pajak: Studi Perusahaan di Indonesia. Jurnal Akuntansi Dan Bisnis, 22(2), 243-256.

Faradiza, S. A. (2019). Dampak Strategi Bisnis terhadap Penghindaran Pajak. Journal of Applied Accounting and Taxation, 4(1), 107-116.

Fuadi, Sudarmanto, E., Nainggolan, B., Martina, S., Rozaini, N., Ningrum, N. P., Hasibuan, A. F. H., Rahmadana, M. F., Basmar, E., & Hendrawati E. (2021). Ekonomi Syariah. Medan: Yayasan Kita Menulis.

Hanlon, M. & Heitzmen, S. (2010). A Review of Tax Research. Journal of Accounting and Economics. September. 50, 127-178.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the Firm: Managerial behavior, Agency Costs and Ownership Structure. Journal of Financial Economics, 3(4), 305-360.

Leon, H., & Apriyanto, V. (2024). Religiousness as a Shield in Corporate Tax avoidance. JAS (Jurnal Akuntansi Syariah), 8(2), 272-294.

Mahdiana, M. Q., & Amin, M. N. (2020). Pengaruh Profitabilitas, Leverage, Ukuran Perusahaan, dan Sales Growth Terhadap Tax Avoidance. Jurnal Akuntansi Trisakti, 7(1), 127-138.

Paramita, A. S., Ardiansah, M. N., Delyuzar, R. A., & Dzulfikar, A. (2022). The Analysis of Leverage, Return on Assets, and Firm Size on Tax avoidance. Accounting Analysis Journal, 11(3), 186-195.

Prihadi, T. (2019). Analisis laporan keuangan Konsep dan Aplikasi. Jakarta: PT Gramedia Pustaka Utama.

Putra, I. M. (2023). Pengantar Manajemen Pajak Strategi Pintar Merencanakan & Menghindari Sanksi Pajak (R. Az-zahra, Ed.). Yogyakarta: Anak Hebat Indonesia.

Putri, S. L., & Illahi, I. (2023). Pengaruh Leverage, Profitabilitas, Dan Kualitas Audit Terhadap Penghindaran Pajak:(Studi Kasus Perusahaan Pertambangan Yang Terdaftar Di Index Saham Syariah Indonesia (ISSI) tahun 2016-2021). Jurnal Ekonomi dan Bisnis, 1(2), 161-176.

Sausan, A. M., & Soekardan, D. (2024). Pengaruh Tax avoidance Dan Debt covenant Terhadap Transfer Pricing. Inovasi Makro Ekonomi (IME), 6(2).

Sulaeman, A., & Surjandari, D. A. (2024). The Influence of Capital Intensity, Leverage, Profitability, and Corporate Social Responsibility on Tax avoidance with Firm Size as a Moderating Variable. Asian Journal of Economics, Business and Accounting, 24(5), 433-442.

Tanujaya, K., & Erna, E. (2021). Analisis Determinan Penghindaran Pajak di Indonesia. Global Financial Accounting Journal, 5(2), 159-170.

Watts, R. L., & Zimmerman, J. L. (1990). Positive Accounting Theory: A Ten Year Perspective. The Accounting Review, 65(1), 131–156.