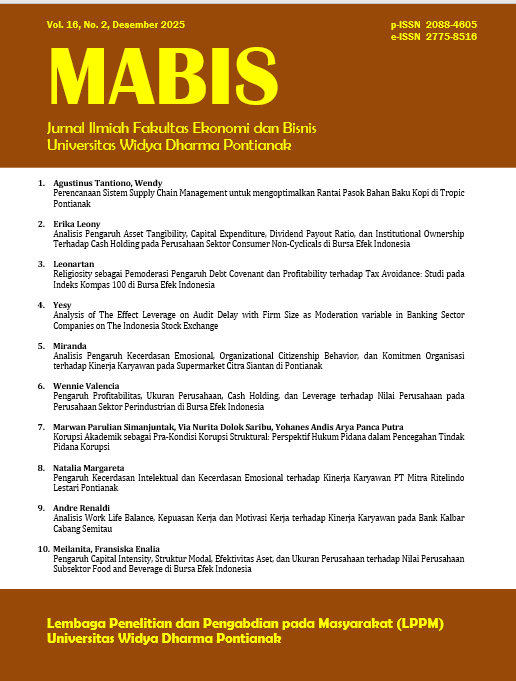

Analisis Pengaruh Asset Tangibility, Capital Expenditure, Dividend Payout Ratio, dan Institutional Ownership Terhadap Cash Holding pada Perusahaan Sektor Consumer Non-Cyclicals di Bursa Efek Indonesia

Keywords:

cash holding, asset tangibility, capital expenditure, dividend payout ratio, institutional ownershipAbstract

The purpose of this study is to determine and analyze the influence of asset tangibility, capital expenditure, dividend payout ratio, and institutional ownership on cash holdings. This is a quantitative study with an associative approach. Data collection was conducted using documentation and literature review techniques. The subjects of this study were non-cyclical consumer sector companies listed on the Indonesia Stock Exchange for the 2019-2023 period, with a population of 129 companies. Using a purposive sampling approach, a sample of 27 companies was obtained and 135 data sets were collected. The data used were secondary data in the form of financial reports and annual reports of non-cyclical consumer sector companies listed on the Indonesia Stock Exchange, obtained from www.idx.co.id and the company's official website. Data analysis was performed using SPSS version 26. The results indicate that asset tangibility and institutional ownership have a negative and significant effect on cash holdings. Meanwhile, the dividend payout ratio has a positive and significant effect on cash holdings. Capital expenditure has no significant effect on cash holdings.

References

Abdioğlu, N. (2016). Managerial Ownership and Corporate Cash Holdings: Insights from an Emerging Market. Business and Economics Research Journal, 7(2), 29-41.

Adha, A., & Akmalia, A. (2023). Pengaruh Profitabilitas, Likuiditas, Leverage, Firm Size, dan Kepemilikan Institusional terhadap Cash Holding (Studi pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia Tahun Periode 2016-2020). Journal of Ecotourism and Rural Planning, 1(1), 1-17.

Arora, R. K. (2019). Corporate Cash Holdings: An Empirical Investigation of Indian Companies. Global Business Review, 20(4), 1088-1106.

Chandra, E. A., & Ardiansyah. (2022). Faktor-Faktor yang Mempengaruhi Cash Holding pada Perusahaan Manufaktur. Jurnal Ekonomi, 27(3), 302-317.

Christina, Y. T., & Ekawati, E. (2014). Excess Cash Holdings dan Kepemilikan Institusional pada Perusahaan Manufaktur yang Terdaftar di BEI. Jurnal Manajemen, Strategi Bisnis, dan Kewirausahaan, 8(1), 1-10.

Fahmi, I. (2015). Analisis Laporan keuangan. Bandung: Alfabeta.

Gracias, D. L., & Osesoga, M. S. (2024). Determinant Factors of Cash Holding: Evidence from Indonesia. ULTIMA Accounting: Jurnal Ilmu Akuntansi, 16(1), 37-48.

Hamdani. (2016). Good Corporate Governance: Tinjauan Etika dalam Praktik Bisnis. Jakarta: Mitra Wacana Media.

Hery. (2016). Akuntansi Dasar 1 dan 2. Jakarta: PT Grasindo.

Liestyasih, L. P. E., & Wiagustini, L. P. (2017). Pengaruh Firm Size dan Growth Opportunity terhadap Cash Holding dan Firm Value. E-Jurnal Ekonomi dan Bisnis Universitas Udayana, 10(6), 3607-3636.

Ridha, A., Wahyuni, D., & Sari, D. M. (2019). Analisis Pengaruh Kepemilikan Institusional dan Profitabilitas terhadap Cash Holding dengan Ukuran Perusahaan sebagai Variabel Moderasi pada Perusahaan Terindeks LQ45 di Bursa Efek Indonesia. Jurnal Manajemen dan Keuangan, 8(2), 135-150.

Sari, L. P., Kurniawati, S. L., & Wulandari, D. A. (2019). The Determinants of Cash Holdings and Characteristics of the Industrial Business Cycle in Indonesia. Jurnal Keuangan dan Perbankan, 23(4), 525-539.

Senjaya, S. Y., & Yadnyana, I. K. (2016). Analisis Pengaruh Investment Opportunity Set, Cash Conversion Cycle, dan Corporate Governance Structure terhadap Cash Holdings. E-Jurnal Ekonomi dan Bisnis Universitas Udayana, 5(8), 2549-2578.

Sumarsan, T. (2018). Akuntansi Dasar dan Aplikasi dalam Bisnis Versi IFRS, Edisi 2, Jilid 2. Jakarta: PT Indeks.

Sutrisno, B., & Gumanti, T. A. (2016). Pengaruh Krisis Keuangan Global dan Karakteristik Perusahaan terhadap Cash Holding Perusahaan di Indonesia. Jurnal Siasat Bisnis, 20(2), 130-142.

Vuković, B., Mijić, K., Jakšić, D., & Saković, D. (2022). Determinants of Cash Holdings: Evidence from Balkan Countries. Economics and Management, 25(1), 130-142.

Wijanto, M. V., & Yanti. (2021). Net Working Capital, Capital Expenditure, Leverage, Board Size, dan Cash Holdings. Jurnal Ekonomi, 26(11), 285-302.

Wirianata, H., Viriany, Sari, V. R., & Tanaya, C. C. (2023). Peranan Tata Kelola dalam Penentuan Kas Ditangan. Jurnal Ekonomi, 28(3), 349-366.

www.idx.co.id.

Yanti, Susanto, L., Wirianata, H., & Viriany. (2019). Corporate Governance, Capital Expenditure, dan Cash Holdings. Jurnal Ekonomi, 24(1), 1-14.