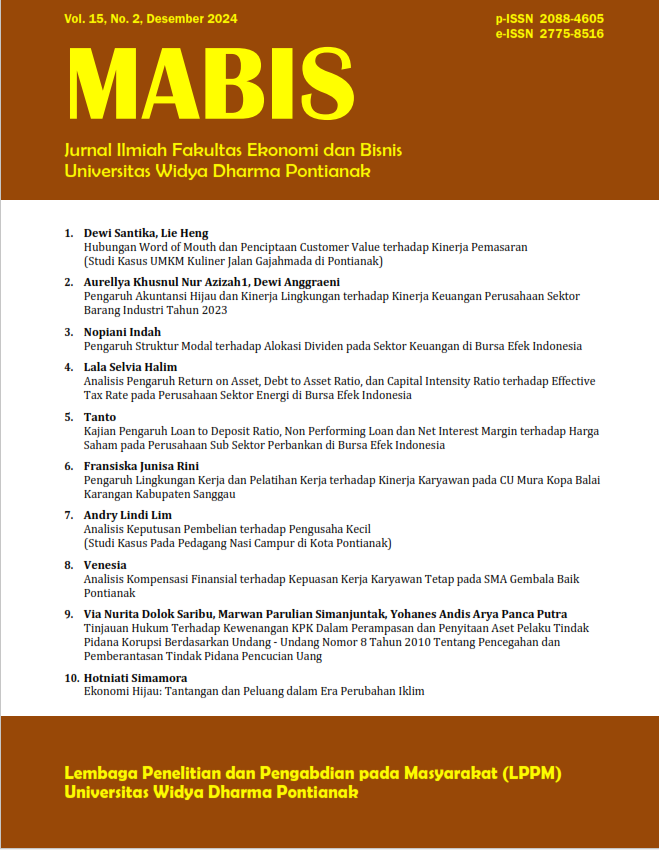

Kajian Pengaruh Loan to Deposit Ratio, Non Performing Loan dan Net Interest Margin terhadap Harga Saham pada Perusahaan Sub Sektor Perbankan di Bursa Efek Indonesia

DOI:

https://doi.org/10.66003/mabis.v15i02.9912Kata Kunci:

loan to deposit ratio, non performing loan, net interest margin, stock pricesAbstrak

Abstract

Shares are a sign of capital participation owned by a person or business entity in a company. Stock prices are prices formed in the market whose magnitude is influenced by the law of supply and demand. The aim of this research is to determine the effect of loan to deposit ratio, non-performing loans and net interest margin on stock prices. The population used in this research is banking sub-sector companies on the Indonesia Stock Exchange. Sampling was carried out using the purposive sampling method. Next, hypothesis testing is carried out using multiple regression analysis. The results of the research are (1) loan to deposit ratio has no effect on stock prices, (2) non-performing loans have no effect on stock prices and (3) net interest margin has a positive effect on stock prices.

Keywords: loan to deposit ratio, non performing loan, net interest margin, stock prices.

Referensi

DAFTAR PUSTAKA

Fauzi, F., Dencik, J., & Asiati, A. 2019. Analisis Regresi Berganda dan Aplikasinya Dalam Penelitian. Rajawali Press.

Febrianto, Dwi Fajar., dan Dul Muid. 2013. “Analisis Pengaruh Dana Pihak Ketiga, LDR, NPL, CAR, ROA, dan BOPO Terhadap Jumlah Penyaluran Kredit (Studi pada Bank Umum yang Terdaftar di Bursa Efek Indonesia Periode Tahun 2009-2012)”. Diponegoro Journal of Accounting, vol. 2, no. 4, hal. 1-11.

Haryanto, B. Satrio., dan Endang Tri Widyarti. 2017. “Analisis Pengaruh NIM, NPL, BOPO, BI RATE dan CAR Terhadap Penyaluran Kredit Bank Umum Go Public Periode Tahun 2012-2016”. Diponegoro Journal of Management, vol. 6, no. 4, hal. 1-11.

Ikatan Bankir Indonesia. 2016. Strategi Manajemen Risiko Bank (Edisi Pertama). PT Gramedia Pustaka Utama.

Kasmir. 2019. Analisis Laporan Keuangan. Rajawali Pers.

________. 2014. Bank dan Lembaga Keuangan Lainnya (Edisi Revisi). Rajawali Pers.

Martanorika, N., & Mustikawati, R. I. 2018. Pengaruh Loan to Deposit Ratio (LDR), Non Performing Loan (NPL), Capital Adequacy Ratio (CAR), Net Interest Margin (NIM) Terhadap Harga Saham Bank Umum Konvensional Yang Terdaftar Di Bursa Efek Indonesia Pada Tahun 2014-2016. Jurnal Profita: Kajian Ilmu Akuntansi, 6(7), Article 7.

Pratiwi, Susan., dan Lela Hindasah. 2014. Pengaruh Dana Pihak Ketiga, Capital Adequacy Ratio, Return on Assets, Net Interest Margin, dan Non Performing Loan Terhadap Penyaluran Kredit Bank Umum di Indonesia. Jurnal Manajeman dan Bisnis, vol. 5, no. 2.

Ratnasih, C., & Purbayani, D. M. 2018. Pengaruh Return on Asset (ROA), Loan to Deposit Ratio (LDR), Dan Capital Adequancy Ratio (CAR) Terhadap Harga Saham Pada Pt. Bank Negara Indonesia Tbk. JURNAL MANAJEMEN FE-UB, 6(2), Article 2.

Samsul, M. 2015. Pasar Modal dan Manajemen Portofolio (Edisi kedua). Erlangga.

Siregar, Syofian. 2014. Metode Penelitian Kuantitatif Dilengkapi Dengan Perbandingan Perhitungan Normal dan SPSS. Kencana.

www.idx.co.id