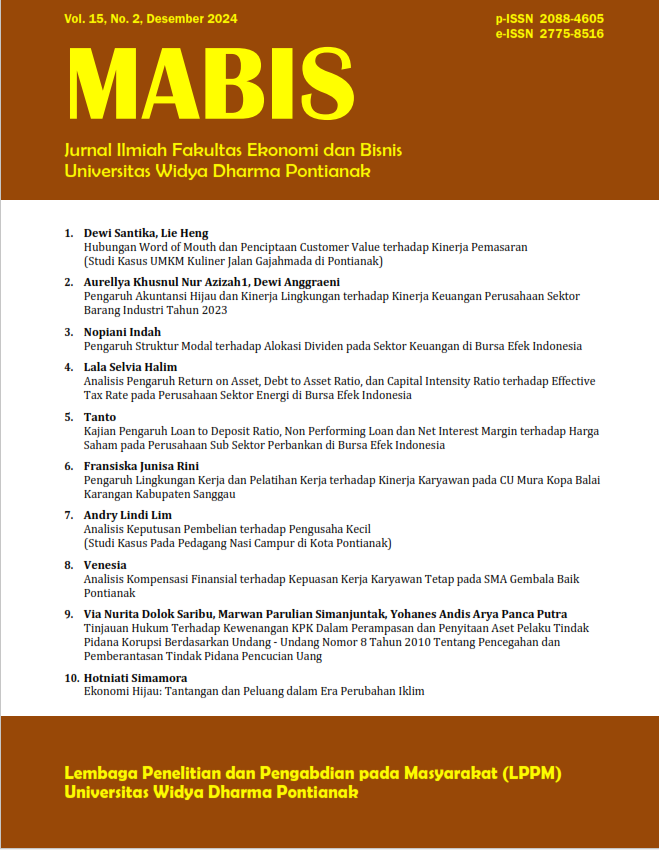

Pengaruh Struktur Modal terhadap Alokasi Dividen pada Sektor Keuangan di Bursa Efek Indonesia

DOI:

https://doi.org/10.66003/mabis.v15i02.8437Kata Kunci:

struktur modal, alokasi dividen, debt to equity ratio, debt to asset ratio, dividend payout ratioAbstrak

Capital structure and dividend allocation are two critical elements in corporate financial management, especially in the financial sector, which has unique characteristics such as strict regulations and high operational risks. This study aims to analyze the impact of capital structure, measured by Debt to Equity Ratio (DER) and Debt to Asset Ratio (DAR), on dividend allocation, represented by the Dividend Payout Ratio (DPR). Data were collected from the financial statements of 53 financial sector companies listed on the Indonesia Stock Exchange (IDX) for the 2022–2023 period. Multiple linear regression analysis revealed that the effects of DER and DAR on DPR were not significant. Factors such as regulation, profitability, and liquidity play a more dominant role in determining dividend policies. These findings provide strategic insights for financial sector companies to balance high leverage with effective dividend policies to enhance their attractiveness to investors.

Referensi

Azhari, M., & Rahmawati. (2020). Pengaruh struktur modal terhadap kebijakan dividen pada perusahaan sektor keuangan. Journal of Financial Studies, 12(3), 45–56.

Fahmi, I. (2018). Pengantar manajemen keuangan. Bandung: Alfabeta.

Hartono, J., & Kusuma, T. (2022). Struktur modal, risiko keuangan, dan dividen: Studi pada Bursa Efek Indonesia. Asian Finance Journal, 19(1), 45–59.

Hidayat, R. (2022). Struktur modal dan dividen di pasar modal Indonesia. Contemporary Finance Journal, 8(1), 56–70.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Kasmir. (2019). Analisis laporan keuangan. Depok: Rajawali Pers.

Marlina, E. (2021). Faktor-faktor penentu dividen di sektor keuangan. Global Economic Review, 20(3), 134–150.

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221.

Pratama, Y. (2020). Analisis rasio keuangan dalam menentukan dividen pada sektor keuangan. International Journal of Business Studies, 18(2), 90–103.

Rahman, A., & Utami, S. (2019). Pengaruh leverage terhadap kebijakan dividen di sektor keuangan. Indonesian Economic Journal, 14(3), 76–89.

Ross, S. A. (1977). The determination of financial structure: The incentive-signalling approach. Bell Journal of Economics, 8(1), 23–40.

Santoso, L. (2021). Struktur modal dan dividen: Studi empiris pada sektor keuangan. Finance and Economics Review, 15(4), 67–78.

Siregar, T., & Handayani, R. (2019). Hubungan antara DER, DAR, dan DPR di Bursa Efek Indonesia. Economic Research Journal, 10(1), 34–49.

Sutrisno, A. (2019). Pengaruh struktur modal terhadap pembayaran dividen di BEI. Accounting and Finance Journal, 10(4), 145–160.

Widodo, A., & Lestari, D. (2018). Analisis kebijakan dividen dan struktur modal pada sektor perbankan. Journal of Banking and Finance, 7(2), 120–135.