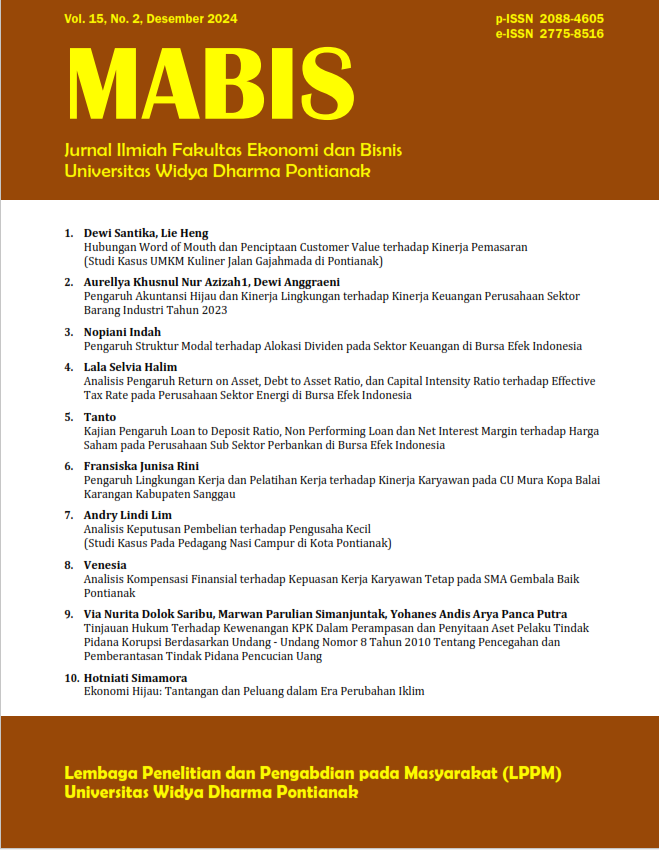

Ekonomi Hijau: Tantangan dan Peluang dalam Era Perubahan Iklim

DOI:

https://doi.org/10.66003/mabis.v15i02.10483Kata Kunci:

ekonomi hijau, keuangan berkelanjutan, perubahan iklim, manajemen risiko, regulasi keuanganAbstrak

Artikel ini mengkaji transformasi sektor keuangan global menuju paradigma ekonomi hijau dalam konteks krisis iklim yang semakin mendesak. Dengan meningkatnya kesadaran akan risiko sistemik yang ditimbulkan oleh perubahan iklim, lembaga keuangan menghadapi tekanan untuk mengintegrasikan pertimbangan keberlanjutan ke dalam strategi dan operasi mereka. Penelitian ini mengevaluasi perkembangan terkini dalam keuangan hijau, termasuk inovasi dalam instrumen keuangan berkelanjutan, evolusi kerangka regulasi, dan pergeseran paradigma dalam penilaian risiko. Metodologi yang digunakan mencakup analisis literatur komprehensif, studi kasus komparatif, dan analisis data sekunder dari laporan industri dan regulasi. Temuan utama menunjukkan bahwa meskipun ada kemajuan signifikan dalam pengembangan produk keuangan hijau dan peningkatan pengungkapan terkait iklim, masih terdapat kesenjangan substansial dalam standardisasi, pengukuran dampak, dan penyelarasan insentif. Tantangan kritis yang diidentifikasi meliputi kebutuhan akan metrik keberlanjutan yang terstandarisasi, pengelolaan risiko transisi yang efektif, dan pengembangan kerangka regulasi yang koheren secara global. Penelitian ini berkontribusi pada literatur dengan menyediakan kerangka analitis untuk memahami dinamika transformasi sektor keuangan menuju ekonomi hijau dan mengidentifikasi area prioritas untuk intervensi kebijakan dan inovasi pasar.

Referensi

Acemoglu, D., Aghion, P., Bursztyn, L., & Hemous, D. (2012). The environment and directed technical change. American Economic Review, 102(1), 131-66.

Bank of England. (2019). The 2021 biennial exploratory scenario on the financial risks from climate change. Bank of England

Bank of England. (2021). Key elements of the 2021 Biennial Exploratory Scenario: Financial risks from climate change. Bank of England.

Batten, S., Sowerbutts, R., & Tanaka, M. (2020). Climate change: Macroeconomic impact and implications for monetary policy. In Ecological, Societal, and Technological Risks and the Financial Sector (pp. 13-38). Palgrave Macmillan.

Battiston, S., & Monasterolo, I. (2020). A climate risk assessment of sovereign bonds' portfolio. SSRN Electronic Journal.

Battiston, S., et al. (2017). A climate stress-test of the financial system. Nature Climate Change, 7(4), 283-288.

Battiston, S., Mandel, A., Monasterolo, I., Schütze, F., & Visentin, G. (2017). A climate stress-test of the financial system. Nature Climate Change, 7(4), 283-288.

Berg, F., Koelbel, J. F., & Rigobon, R. (2022). Aggregate Confusion: The Divergence of ESG Ratings. Review of Finance, 26(6), 1315-1344.

Berg, F., Koelbel, J. F., & Rigobon, R. (2022). Aggregate Confusion: The Divergence of ESG Ratings. Review of Finance, 26(6), 1315-1344.

Berg, F., Koelbel, J. F., & Rigobon, R. (2022). Aggregate Confusion: The Divergence of ESG Ratings. Review of Finance, 26(6), 1315-1344

Bingler, J. A., & Colesanti Senni, C. (2020). Taming the Green Swan: How to improve climate-related financial risk assessments. CER-ETH Economics Working Paper Series, 20/340.

Bolton, P., Despres, M., Pereira da Silva, L. A., Samama, F., & Svartzman, R. (2020). The green swan: Central banking and financial stability in the age of climate change. Bank for International Settlements.

Bolton, P., Despres, M., Pereira da Silva, L. A., Samama, F., & Svartzman, R. (2020). The green swan: Central banking and financial stability in the age of climate change. Bank for International Settlements.

Bruyère, R., et al. (2020). Derivatives and sustainable finance: Futures, forwards, options and swaps for ESG. In The Palgrave Handbook of Environmental Finance (pp. 639-657). Palgrave Macmillan.

Campiglio, E., Dafermos, Y., Monnin, P., Ryan-Collins, J., Schotten, G., & Tanaka, M. (2018). Climate change challenges for central banks and financial regulators. Nature Climate Change, 8(6), 462-468.

Carney, M. (2015). Breaking the Tragedy of the Horizon - climate change and financial stability. Speech given at Lloyd's of London, 29 September 2015.

Coeuré, B. (2018). Monetary policy and climate change. Speech at conference on "Scaling up Green Finance: The Role of Central Banks", Berlin, 8 November.

DAFTAR PUSTAKA

de Boer, A., & van Bergen, B. (2021). Applying the EU Taxonomy to Your Business. Climate Focus

Delmas, M. A., & Burbano, V. C. (2011). The Drivers of Greenwashing. California Management Review, 54(1), 64-87.

Dietz, S., Bowen, A., Dixon, C., & Gradwell, P. (2016). 'Climate value at risk' of global financial assets. Nature Climate Change, 6(7), 676-679

D'Orazio, P., & Popoyan, L. (2019). Fostering green investments and tackling climate-related financial risks: Which role for macroprudential policies? Ecological Economics, 160, 25-37.

Double Materiality: What Is It and Why Does It Matter? (2021). SSRN Electronic Journal.

Eccles, R. G., & Stroehle, J. C. (2018). Exploring Social Origins in the Construction of ESG Measures. SSRN Electronic Journal.

Eccles, R. G., Lee, L. E., & Stroehle, J. C. (2020). The Social Origins of ESG: An Analysis of Innovest and KLD. Organization & Environment, 33(4), 575-596

EU Technical Expert Group on Sustainable Finance. (2020). Taxonomy: Final report of the Technical Expert Group on Sustainable Finance. European Commission.

European Central Bank. (2021). ECB economy-wide climate stress test. European Central Bank

European Commission. (2019). Regulation (EU) 2019/2088 on sustainability‐related disclosures in the financial services sector. Official Journal of the European Union.

Flammer, C. (2021). Corporate green bonds. Journal of Financial Economics, 142(2), 499-516.

Flammer, C., Hong, B., & Minor, D. (2019). Corporate governance and the rise of integrating corporate social responsibility criteria in executive compensation: Effectiveness and implications for firm outcomes. Strategic Management Journal, 40(7), 1097-1122.

Friede, G., Busch, T., & Bassen, A. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment, 5(4), 210-233.

Gillenwater, M. (2013). What is Additionality? Part 1: A long-standing problem. GHG Management Institute

Global Impact Investing Network. (2020). Annual Impact Investor Survey 2020. GIIN.

Global Reporting Initiative. (2021). GRI Standards. GRI.

IFRS Foundation. (2021). IFRS Foundation announces International Sustainability Standards Board. IFRS

International Capital Market Association. (2018). Green Bond Principles: Voluntary Process Guidelines for Issuing Green Bonds. ICMA.

IPCC. (2021). Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press.

Keenan, J. M. (2019). A climate intelligence arms race in financial markets. Science, 365(6459), 1240-1243

Kölbel, J. F., Heeb, F., Paetzold, F., & Busch, T. (2020). Can Sustainable Investing Save the World? Reviewing the Mechanisms of Investor Impact. Organization & Environment, 33(4), 554-574.

Krueger, P., Sautner, Z., & Starks, L. T. (2020). The importance of climate risks for institutional investors. The Review of Financial Studies, 33(3), 1067-1111

Krüeger, P., Sautner, Z., & Starks, L. T. (2020). The importance of climate risks for institutional investors. The Review of Financial Studies, 33(3), 1067-1111

Loan Market Association. (2021). Sustainability Linked Loan Principles. LMA.

Maltais, A., & Nykvist, B. (2020). Understanding the role of green bonds in advancing sustainability. Journal of Sustainable Finance & Investment, 1-20.

Meckling, J., Sterner, T., & Wagner, G. (2017). Policy sequencing toward decarbonization. Nature Energy, 2(12), 918-922

Morningstar. (2021). Global Sustainable Fund Flows: Q4 2020 in Review. Morningstar Research.

Network for Greening the Financial System. (2019). A call for action: Climate change as a source of financial risk. NGFS.

Network for Greening the Financial System. (2020). Guide to climate scenario analysis for central banks and supervisors. NGFS

NGFS. (2021). NGFS Climate Scenarios for central banks and supervisors. Network for Greening the Financial System

PCAF. (2020). The Global GHG Accounting and Reporting Standard for the Financial Industry. Partnership for Carbon Accounting Financials

Schoenmaker, D., & Schramade, W. (2019). Principles of Sustainable Finance. Oxford University Press.

Science Based Targets initiative. (2021). SBTi Corporate Manual. SBTi

Stern, N. (2007). The Economics of Climate Change: The Stern Review. Cambridge University Press.

Stern, N., & Stiglitz, J. E. (2021). The Social Cost of Carbon, Risk, Distribution, Market Failures: An Alternative Approach. National Bureau of Economic Research.

Sustainability Accounting Standards Board. (2018). SASB Conceptual Framework. SASB.

Suttor-Sorel, L. (2019). Making Finance Serve Nature. Finance Watch Report.

TCFD. (2017). Final Report: Recommendations of the Task Force on Climate-related Financial Disclosures. Financial Stability Board.

TCFD. (2017). Recommendations of the Task Force on Climate-related Financial Disclosures. Financial Stability Board.

TCFD. (2021). 2021 Status Report. Task Force on Climate-related Financial Disclosures.

Thomä, J., & Chenet, H. (2017). Transition risks and market failure: a theoretical discourse on why financial models and economic agents may misprice risk related to the transition to a low-carbon economy. Journal of Sustainable Finance & Investment, 7(1), 82-98.

Tolliver, C., Keeley, A. R., & Managi, S. (2020). Green bonds for the Paris agreement and sustainable development goals. Environmental Research Letters, 15(1), 014007

UNEP. (2011). Towards a Green Economy: Pathways to Sustainable Development and Poverty Eradication. United Nations Environment Programme

World Bank. (2020). Developing a National Green Taxonomy: A World Bank Guide. World Bank Group.

World Economic Forum. (2020). Bridging the Gap in Sustainable Development Finance. WEF.